Preventing the Forward Buy effect: boost profits with promo support

-

Radosław Stępień

Reading time: 6 min -

Daniel Giliciński

Reading time: 6 min

Date: 29 January 2024

Date: 29 January 2024

Each enterprise strives to achieve as much profit from selling their goods and services, by definition; however, not every institution implements a dedicated strategy. The Revenue Growth Management (RGM) concept is an approach focused on continuous revenue maximization. Through deploying and appropriate maintenance of RGM software, companies can benefit from complex analyses of trends and data. As a result, they gain knowledge about how to plan properly upcoming and current promotional activities, pricing and product strategies, and manage contracts, including the right time and market situation. The Revenue Growth Management strategy is a very useful tool, especially in the CPG industry. In this case, this is due to the higher comprehensiveness of using advanced data analysis, and the implementation of relevant activities is crucial for the profitability of the production company.

This article will provide insights into:

- What is Stock Forward Buy (FWB), and how does it influence the CPG industry?

- What are the consequences of an FWB occurrence for the manufacturer?

- How does a producer can protect themselves from the Stock Forward Buy effect?

What is a Stock Forward Buy?

The Revenue Growth Management approach means both a number of benefits and threats if its assumptions are implemented improperly. It is estimated that more than 60% of revenue growth in the world’s top 50 CPG companies comes not from volume sales growth but from price optimization and promotional activities. The effective management of revenue maximization is crucial for production companies to stay in the competitive CPG market.

One of the methods that could be harmful to an unconscious manufacturer in the CPG industry is the Stock Forward Buy concept, especially in trade promotion. The official definition describing the title process says that it is “a process related to retail inventory, financial instruments, assets, and more, in which they are purchased in quantities that exceed demand to prevent the future price increase.”

In general, the above description is very accurate, and we could stop there. However, I would like to not break down into prime factors but show you how FWB works in the CPG industry, what negative effect it causes (for the producer), and how to counteract it.

Let’s do this!

Sell in vs. Sell out

The analysis of this effect should start with explaining a few terms. Let’s begin with “Sell-in” and “Sell-out” expressions that apply to sales data. The “Sell-in” term defines the sales volume on the manufacturer->retailer line, while the “Sell-out” term refers to the retailer->consumer line. I guess business practitioners accuse me at this point that I oversimplify those two expressions; however, I assume it is more than enough for this article.

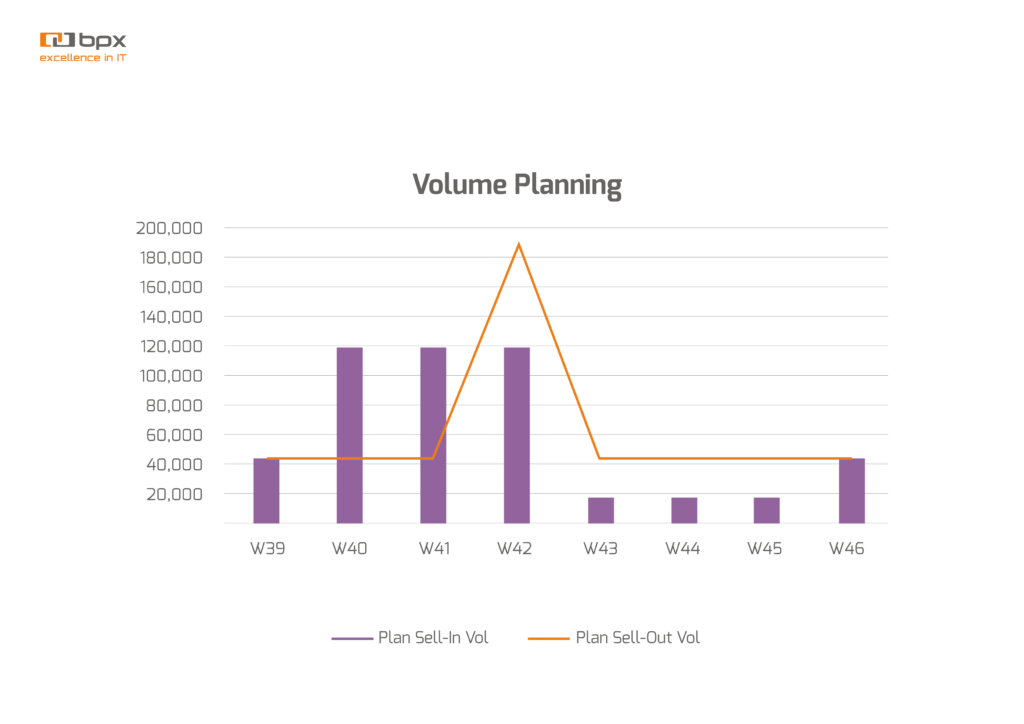

Planning sales volume – the customer and retailer outlook

The chart below shows the relations between “Sell-in” and “Sell-out” during the sales volume planning process. The blue columns apply to the quantity of goods which is going to be sold to a retailer, and the orange line indicates the amount of product and the time it will be purchased by the customer.

The consumer’s perspective

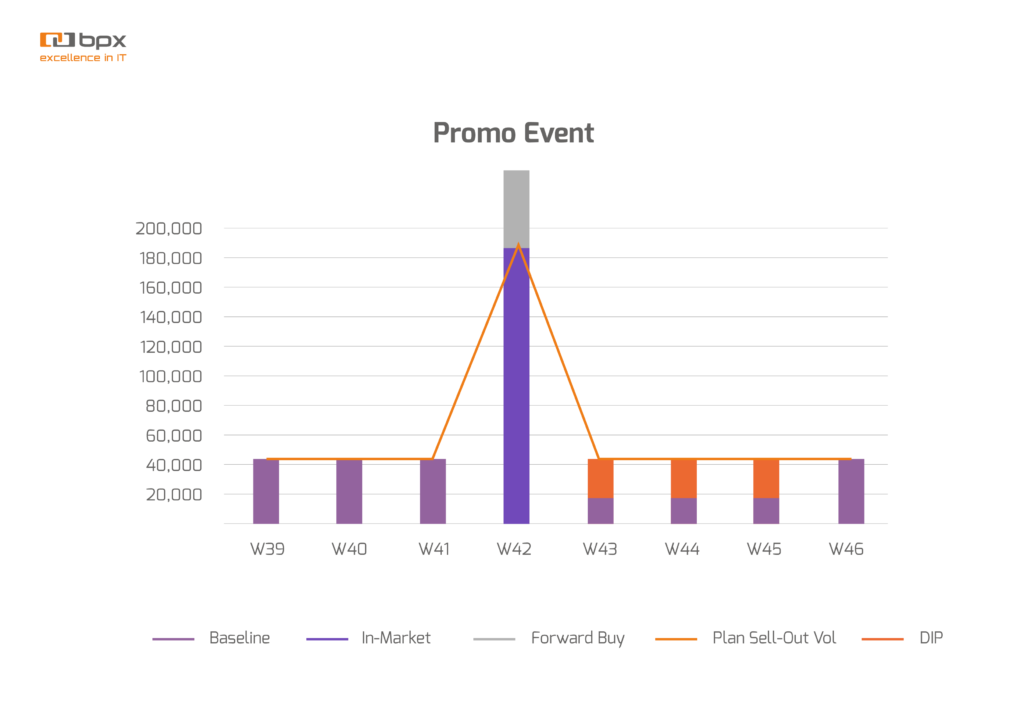

Before we look at the following graph, let’s explain what is the “Sale Baseline.” In the simplest way, it means a reference point to what quantity of product would be bought by a customer if there are no promotional activities.

In the chart below, it is visible, how the sales volume is changing due to a well-planned promotional action.

The retailer outlook – an example

Let’s take a look at this process from the retailer’s point of view. The manufacturer recommended creating a 10% promotion on yogurts of the XYZ brand in the W42 period, both for a retailer and a customer.

The Stock Forward Buy effect implies stocking in much higher amounts than was predicted in the promotion plan. So after the end of the promotion, it would be possible to sell the above-mentioned product at full price “on the shelf” and, as a result, earn an extra 10% profit from the sale.

In this case, the manufacturer is lossy because, until they sell off the “promotional” stuff by the retailer, it will be ordering negligible quantities. The difference between a standard-planned sale and an actual-reduced sale, in an already closed promotion is called the DIP effect (it’s worth mentioning that this effect has to be included by the manufacturer when the production is planned).

How to prevent the negative effects of Forward Buy?

The first step that can be taken to avoid negative consequences of FWB is monitoring the sales volume based on Sell-in/Sell-out data and comparing it with planned volumes. If there are great variances, you should respond.

Secondly, it’s worth implementing a plan in place, according to the Trade Promotion Management (TPM) approach, which describes the process of budgeting, planning, and agreeing on trade expenses of the company to increase sales and profitability while improving the productivity of the sales and finances department. It’s good to use the best tools for planning promotion activities for this purpose. The latest software, thanks to AI, helps to predict the level of Forward Buy as early as during the planning promotion stage, as well as validate when it lasts.

Aiming at effective promotion planning and working on eliminating the FWB effect, it’s essential to change the approach to planning promotion from looking for additional volume to planning customer activation, both toward manufacturer and retailer needs. Right Trade Promotion Management (TPM) tools make it possible to very detailed plan (and compare with each other) re-selling mechanisms for consumers and translate their effects to volume and financial results.

Trade Promotion Management (TPM) tools enable very accurate planning of promotion accounting methods with retailers. They provide real-time insight into a full profit and loss from planned re-selling action to the user, both from the manufacturer and retailer’s point of view. One of the most common methods to completely avoid the Forward Buy effect is retrospectively settling on the number of re-sale pieces based on re-selling data. The TPM tools allow for detailed planning and enforcing promotion due to full system integration with selling (manufacturer) and re-selling data (retailer).

If there is a lack of re-selling data and the necessity (mostly because of existing trade agreements) of planning discounts on an invoice, it’s worth using TMP tools to analyze specific reasons for FWB background. In this way, thanks to more detailed planning, we would reduce future FWB effects.

The basic Forward Buy effects include:

- Pre–promoted FWB – it’s the effect of having an open discount window and retailer’s purchasing before starting promotion in a store, resulting in buying (and also can cause re-selling) products with a promotional discount, which should come from a volume base;

- In promotion FWB – it’s the effect occurs in the case of consumer activation mechanisms, when the consumer can, but doesn’t have to, benefit from a proposed discount in the store (e.g. 2+1 promotion – consumer won’t buy two pieces so that won’t take advantage of proposed discount);

- Post-promoted FWB – it’s the effect related to purchase over occurring re-selling, while the retailer re-sells purchased stuff, which he bought with a discount, at regular prices.

The analysis of various FWB effects through the overall promoting cycle – starting with planning, over execution, to post evaluation, is a powerful knowledge tool allowing prevent negative FWB effects by changes from promotion to promotion, supported by data.

Foremost – as the manufacturer, you should check in the BPX company, which is an expert in implementing RGM. We help you both eliminate Forward Buy and increase profits from promotional activities.

Contact us and find out how our solutions to revenue management can support your strategic goals. We draw up a business analysis so you can see in what way our systems and trade promotion management processes could fit into your ERP ecosystem and supply chain to improve the operating efficiency of your organization.

See recent writings

You drive us to strive for excellence in delivered projects and common challenges. Feel invited to read out blog that provides more in-depth knowledge on our implementations and experience. Read articles about digital business transformation, ERP and Business Intelligence systems. Discover interesting practical applications for future technologies.

Contact us!

Let’s talk! Are you interested in our solutions? Our experts are happy to answer all of your questions.

pl

pl