Your banking command center

directly in SAP

Meet Banking eXcellence and manage your company's finances from one place.

Banking eXcellence

The bridge between SAP ERP and e-banking.

You no longer need to switch between online banking and a financial and accounting / ERP system.

Banking eXcellence is an innovative solution that allows you to complete the payment process entirely in your company's SAP system, without logging into the bank.

Banking eXcellence Cockpits

The bridge between SAP ERP and e-banking. Our proprietary solution, developed by BPX programmers and consultants, allows you to manage the entire payment process of your company from one place.

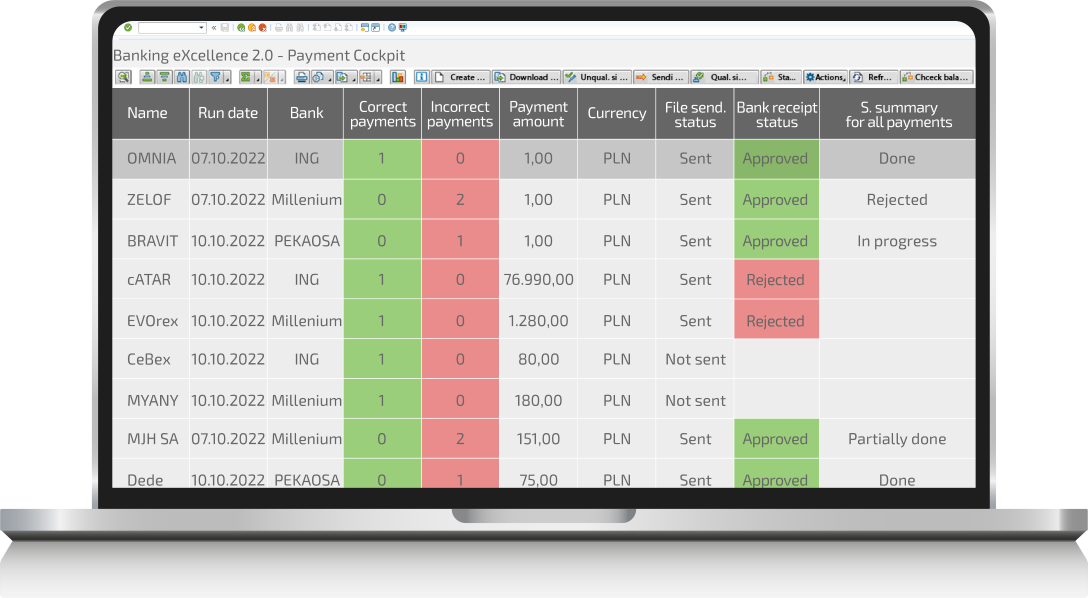

Payment Cockpit

Bank Statement Cockpit

Your command center directly from SAP

You no longer have to switch between online banking and the financial and accounting system / ERP.

Benefits of Banking eXcellence -

A Solution Customized to Your Needs!

-

Save time and money with a more user-friendly approach compared to traditional methods.

-

Choose according to your preferences - license or subscription.

-

No need for an additional package to execute SWIFT transfers - save even more!

-

Authorization with signatures in SAP, rather than in a bank application/external provider - gain more control.

Use the BPX Banking eXcellence

solution and complete the payment process from a single cockpit

Banking eXcellence in 5 easy steps

-

1.

Possibility of making transfers directly from SAP

-

2.

Authorization of transfers in SAP

(in accordance with the authorization at the bank) -

3.

Display and monitoring of transfer statuses

-

4.

Information about the current account balance

-

5.

Downloading statements

How does it work?

The most important functionalities provided

by Banking eXcellence include:

Benefits for your company:

Shorter transfer

processing time

Automatic real-time

data exchange

with banks

Transparency and control

over the process

of settling liabilities

Easy-to-use interface

Flexibility

Security of

data exchange

Lowering of transaction costs

High data quality

thanks to the reduction

of error risk

The Banking eXcellence cockpit will work

especially well in companies that:

Use multiple bank accounts.

Have a large volume of transactions, which is too time-consuming to manage from the level of the banking application.

Do not have a central panel with information about each completed transfer.

Need immediate information on inflows to bank accounts.

We work with the best

The implementation process in your company.

We work with the best and share our know-how with banks such as: ING Polska, PKO BP, Bank Pekao SA, Santander Bank Polska, Citibank, BNP Paribas or Bank Millennium, and the offer of banks supported by our solution is constantly expanding.

Thanks to the Banking eXcellence solution, our long-standing expertise and proven standards of cooperation with banks, we are able to carry out the entire implementation process within 4 weeks from starting work.

Banking eXcellence

We attach great importance to ensuring that our solution offers the highest quality and is developed with the benefit of and taking into account the needs of our customers.

The solution is available as part of a monthly subscription, thanks to which all new functionalities are delivered without the need to pay additional fees.

Take advantage of

Banking eXcellence in

your company!

-

Contact our

expert -

We will analyze

the needs of your company

and propose a comprehensive solution -

We will build an action

plan taking into

account all elements

of cooperation -

We will sign a contract

-

We act and your company

benefits from Banking eXcellence!

Users appreciate Banking eXcellence

Banking eXcellence cockpit features

- displaying basic information about the course of payment,

- creating a payment medium,

- authorization of the payment for execution,

- signing the payment,

- payment rejection,

- activation of the mass payment functionality and change of the title of the mass package,

- sending a payment to bank,

- payment status display,

- displaying return messages from the bank.

- displaying all items from the selected payment group,

- displaying basic data of a single payment,

- changing of the title of a single payment,

- downloading a bank payment confirmation in PDF format.

- displaying all documents that make up a given payment,

- displaying basic data of a single payment,

- change of the title of a single payment,

- the possibility of a smooth transition from the cockpit directly to displaying the details of a single document included in the payment.

Additional features

In addition, the Banking eXcellence cockpit allows you to reverse a single transfer without having to reverse the entire package.

From the cockpit level, it is possible to manually change the transfer title or the entire transfer package, which is especially useful for payroll payments and not available as standard in the system.

What else does your gain?

The encrypted SSL communication channel and the electronic signature used to confirm transfers guarantee your company the highest level of security of the data transmitted between the SAP system and the bank. Banking eXcellence also has a mechanism that prevents multiple sending of the same transfers to the bank.

The advantage of the solution is the possibility of authorization, i.e., signing each transfer with a qualified or unqualified signature by authorized users, directly from the SAP system level and without the need to log into online banking. Data on each transfer is displayed on 3 levels, from a general list of all transfers to the most detailed display of individual documents.

The great strength of the entire solution is also the flexibility that characterizes the entire Banking eXcellence solution. Persons authorized to place qualified signatures can authorize transfers from the level of SAP itself, without the need to authorize them via the banking platform.

Finally, authorized transfers can reach your bank with just one click. From the Banking eXcellence cockpit, we can also see whether our transfer has already been processed, rejected, or is still awaiting execution – so there is no need to log into the bank regularly to supervise the current stage of their implementation.

Real-time data exchange is possible via the Banking eXcellence payment cockpit. The data is refreshed in the background without any delays – the user always sees up-to-date information on the available account balance and the status of each transfer.

Banking eXcellence guarantees full information about the payment process by means of updated statuses of each payment. The user is informed at every stage of the transfer about its processing status:

- Sending to the bank – successful or information about errors,

- Execution status in the bank – e.g., pending authorization, transfer in progress, transfer completed, transfer rejected with the reason for rejection.

Banking eXcellence allows you to check the currently available balance on your bank account. This information is displayed both in the standard SAP automatic payment program and in the cockpit.

Thanks to it, the user is able to compare the planned transfers with the available balance on the bank account and react in the event of not sufficient funds on the account.

The solution in unified manner shows all the aforementioned banking functions in one place, regardless of the bank where the transaction is carried out. Anyone who has used the services of several banks at the same time knows how different in terms of intuition banking platforms can be and how long it can take to find the function that is of interests to us. Using the tool is intuitive and will not be difficult for any employee.

Installation and configuration

The application is compatible with the SAP system in the ECC 6.0 version with each EHP level, as well as with each version of the SAP S/4HANA system (it is possible to adapt it to other versions of the SAP system). We provide an installation package for uploading to the SAP system to the customer.

Installing the application does not introduce any changes to the functioning of standard solutions and programs provided by SAP. For the proper functioning of the application, it is required to adapt the payment format in accordance with ISO XML 20022 version.

About us

BPX is a dynamically developing consulting company specializing in improving business management processes. For over 15 years we have been successfully implementing ERP and Business Intelligence systems in Poland and around the world.

Let's talk